It doesn’t take that long to do all these things; you can knock it out in 30

minutes to 2 hours depending on how much you trade. But regardless of

how long it takes, it’s worth much more than the effort you’ll put into it.

By going over all your trades, you will gain insight into your trading and

you’ll learn what’s working and what isn’t. Those who never review their

trades will never learn what they do right and wrong. Instead, they will

keep making the same mistakes over and over again. By preparing for the

next day, you will get a tremendous head start on the day. Think how much

better you’ll trade if you come in with a game plan and scenarios for all your

trades. No matter what curveball the market throws at you, you’ll be ready.

Hell, they will all look like hanging curves if you are prepared.

Now go and have that beer with John.

Tuesday, November 9, 2010

REVIEW YOUR PLANS AND STRATEGY

Don’t just review the trades but constantly check the plan itself for validity.

You may be losing money and the reason may be that your plan is faulty so keep checking to make sure that it is sound. This is something you will

definitely do during off market hours. It is not something you will do every

night, but every now and then go over all your strategies and make sure

they are doing what you thought they should. If they are, are you following

them? Or maybe you just have strategies that were no good to start

with. Doing this will help keep you on top of your game and ensure you are

trading with a solid strategy.

You may be losing money and the reason may be that your plan is faulty so keep checking to make sure that it is sound. This is something you will

definitely do during off market hours. It is not something you will do every

night, but every now and then go over all your strategies and make sure

they are doing what you thought they should. If they are, are you following

them? Or maybe you just have strategies that were no good to start

with. Doing this will help keep you on top of your game and ensure you are

trading with a solid strategy.

GETTING READY FOR TOMORROW

Now that you have gone over all your previous trades, it’s time to start

focusing on the next day. As you reviewed your open trades you should

have been adjusting your plan for them as you went along. But what about

new trades you may want to put on? You can start looking at charts to see if there are any good setups you may want to trade. You can start creating

entry and exit points for these trades. You can look to see if there are any

schedule reports due. If so, figure out how you will react depending on

what the market does. Say you are trading oil and the American Petroleum

Institute (API) numbers are due tomorrow. If they are indicating a bigger

buildup in reserves than expected, you would expect the market to drop.

But after 20 minutes if it hasn’t dropped then you will go long, otherwise

you will short. If the numbers are weak, you will buy right away and give it

a two-point stop.

Look at your charts and know where all the indicators, trend lines,

and average true ranges are. See how the market closed today and figure

out what you want to do the next day based on different openings. In the

morning, you will follow up on this once you know where the opening is

going to be, but it is better to get a head start the night before.

As you scan charts, have a note of what you are looking for. Are you

looking for a breakout, a reversal, a bounce off of a channel? If you do

find something you like, then be prepared by knowing where you will be

exiting so you can estimate a risk and reward. Do your homework, look at

different time frames, be realistic about what you can expect and what you

can lose. Try to figure out how many contracts you will be trading based

on the risk of the trade. This doesn’t mean you will enter the trade in the

morning, but you are giving yourself a potential trading opportunity that

you have preestablished.

All this is a lot easier if you only trade one market; however, if you

are one of those day traders who has 120 stocks on his screen and trades

almost anything, this reviewing process is a little tougher. What I used to

do when I traded equities was I had a scenario I liked to trade (I looked for

trending stocks that have had a little pullback to a trend line) and I had my

favorite stocks to trade. I would quickly go through them all and see which

fit my setup. I made a list of the stocks that did and these are the ones I

would look to trade the next day if they met further requirements.

By doing the things outlined in this chapter you will be well on the

way to starting the trading day with a solid game plan. You will still have to

make some adjustments to it in the morning, but you should now know how

you will react to different situations in the market. You will have your stops

and exit levels for existing trades. You’ll have entry levels for new trades.

And you’ll even have targets and stops as well as risk and reward ratios.

focusing on the next day. As you reviewed your open trades you should

have been adjusting your plan for them as you went along. But what about

new trades you may want to put on? You can start looking at charts to see if there are any good setups you may want to trade. You can start creating

entry and exit points for these trades. You can look to see if there are any

schedule reports due. If so, figure out how you will react depending on

what the market does. Say you are trading oil and the American Petroleum

Institute (API) numbers are due tomorrow. If they are indicating a bigger

buildup in reserves than expected, you would expect the market to drop.

But after 20 minutes if it hasn’t dropped then you will go long, otherwise

you will short. If the numbers are weak, you will buy right away and give it

a two-point stop.

Look at your charts and know where all the indicators, trend lines,

and average true ranges are. See how the market closed today and figure

out what you want to do the next day based on different openings. In the

morning, you will follow up on this once you know where the opening is

going to be, but it is better to get a head start the night before.

As you scan charts, have a note of what you are looking for. Are you

looking for a breakout, a reversal, a bounce off of a channel? If you do

find something you like, then be prepared by knowing where you will be

exiting so you can estimate a risk and reward. Do your homework, look at

different time frames, be realistic about what you can expect and what you

can lose. Try to figure out how many contracts you will be trading based

on the risk of the trade. This doesn’t mean you will enter the trade in the

morning, but you are giving yourself a potential trading opportunity that

you have preestablished.

All this is a lot easier if you only trade one market; however, if you

are one of those day traders who has 120 stocks on his screen and trades

almost anything, this reviewing process is a little tougher. What I used to

do when I traded equities was I had a scenario I liked to trade (I looked for

trending stocks that have had a little pullback to a trend line) and I had my

favorite stocks to trade. I would quickly go through them all and see which

fit my setup. I made a list of the stocks that did and these are the ones I

would look to trade the next day if they met further requirements.

By doing the things outlined in this chapter you will be well on the

way to starting the trading day with a solid game plan. You will still have to

make some adjustments to it in the morning, but you should now know how

you will react to different situations in the market. You will have your stops

and exit levels for existing trades. You’ll have entry levels for new trades.

And you’ll even have targets and stops as well as risk and reward ratios.

THE CLOSED TRADES

Did You Follow Your Plan?

After you finish reviewing the open trades, you then should go over the

trades you closed out during the day. This is where the real learning begins.

Again, you can do this in any order you like, but I like to go over all my

losers first. I want to learn what I did wrong or right and reviewing is the

best way to do this. The first thing you want to do is to make sure you had

and stuck to a plan for the trades you made.

As you go over every trade ask yourself:

Having and following a plan is so important in being a winning trader.

It is one thing you really need to keep on top of all the time. If you have

a plan and have exit strategies in that plan and you consistently ignored

them, then it’s useless having a plan. You may need someone slapping you

in the back of the head every now and then saying, “Hey stupid, what are you doing? Follow your plan.” If you’ve ever watched the old Pink Panther

movies, you’ll remember Cato, Inspector Clouseau’s martial arts expert

manservant. Cato would constantly jump out of closets and sneakattack

Clouseau to keep his defensive skills and awareness sharp. Well,

maybe we all need to hire a Cato to keep us on our toes and in line every

time we deviate from our plan. It may hurt a little at first, but soon you’ll be

able to stick to your plan much better.

If you didn’t follow your plan, ask yourself why not and what you

should do differently next time to help you follow it. Find out why you

put on every trade, and why you got out of them. If you are diligent about

sticking to a plan, then you don’t have much work to do here, but always

review to make sure you stick to your guns.

The Good Losers

Some losing trades are good trading decisions that didn’t work out and if

you got out with a small loss when you were supposed to, I don’t consider

it a bad trade. A bad trade is when you let it get away or make a stupid, unplanned

trade. Being able to take a good losing trade is the most important

trade of all and this is a behavior I want to reinforce. The reason I think

they are the most important trades of all is that your money is made as a

total of all your trades—winners and losers. You will have losing trades,

and you cannot get around that no matter how good you think you are. But

if you are able to limit losses to a manageable amount and avoid the huge

losses, your net profits will soar and you will be a better trader. I am more

proud of getting out of something with a small loss that would have turned

out to be worse, than I am about having a winning trade. Everyone can get

lucky and make a great winning trade here and there, but only good traders

know how to get out at the right time on the losing side. Even though I may

have lost money on a trade it is a good trade if I did the right thing. When

I review these trades I look to remember what I did to make me get out

quickly so that if I see that situation again I hope to act correctly the next

time as well.

Ones That Got Away

Next you can go over the ones that you just let go. These trades usually fall

into two categories, either you overstayed your welcome and gave back

too much on a winner, or you let a loser go and froze up as you watched it

disintegrate. Either way they are going to really affect your P&L statement.

It only takes one bad trade to wipe you out, even after 10 winners in a row,

so try as hard as possible to not let it happen. You have got to learn to stick

to your exit plans and constantly reviewing this will definitely help.

Don’t be satisfied that you made money on a trade. If you had a 50-

point winner that you turned into a 3-point winner, you screwed up that

trade and gave back your money. At the end of the day, week, month, or

year it’s a total of all your trades that determines how you did, so don’t take

it too lightly if you take a small winner that was once a big one. You lost

that 47 points, that was your money to be had. Find out why.

If I let a trade get really bad, I try to see why I did so, so I don’t do it

again in the future. As you look over the trade, look for the spot you should

have gotten out and try to figure out why you didn’t. It could be because

you had no exit strategy or because you failed to follow one if you did, or

because you got greedy and tried to get more than you could out of a trade.

Or did you freeze up and hope a loser would come back? There are many

reasons you could let a trade get beyond the point where you were suppose

to get out. Figure out why you did so and work on not doing it again. These

are the trades you need to work on the most on because they will draw

down your account faster than the good trades will add to it.

The Good Winners

The last thing I review is my good winning trades and again I’ll try to learn

from them. Good winners are the trades you did everything right on and

made some decent money with. Don’t just look at it and say “good trade”

and move on. Really delve into it. Ask yourself, “Why was it a good trade

and what did I do right?” Did you just get lucky or did you really do something

right. If you did something right, then make sure you keep doing it.

By studying trades you may find that every time you make a trade with a

certain setup it works great, but if a certain variable was changed a little it

doesn’t work as well. Only thorough reviewing will tell you things like this.

If you are a person who has trouble following a game plan, and odds

are you are or you wouldn’t have bought this book, keep track of how you

did on trades where you followed a plan, had an entry point, and came up

with a predetermined exit level. And then keep track of those trades you

put on with little preparation. Next, compare them to see how they do.

Hopefully you will see a big discrepancy and realize that you need to have

and follow a strategy/plan when you trade if you really want to succeed.

After you finish reviewing the open trades, you then should go over the

trades you closed out during the day. This is where the real learning begins.

Again, you can do this in any order you like, but I like to go over all my

losers first. I want to learn what I did wrong or right and reviewing is the

best way to do this. The first thing you want to do is to make sure you had

and stuck to a plan for the trades you made.

As you go over every trade ask yourself:

- Why did I make this trade?

- Did I have an entry plan when I got in?

- Did I have an exit plan for the trade?

- Did I followmy plan?

- What did I do differently and why didn’t I follow that plan?

Having and following a plan is so important in being a winning trader.

It is one thing you really need to keep on top of all the time. If you have

a plan and have exit strategies in that plan and you consistently ignored

them, then it’s useless having a plan. You may need someone slapping you

in the back of the head every now and then saying, “Hey stupid, what are you doing? Follow your plan.” If you’ve ever watched the old Pink Panther

movies, you’ll remember Cato, Inspector Clouseau’s martial arts expert

manservant. Cato would constantly jump out of closets and sneakattack

Clouseau to keep his defensive skills and awareness sharp. Well,

maybe we all need to hire a Cato to keep us on our toes and in line every

time we deviate from our plan. It may hurt a little at first, but soon you’ll be

able to stick to your plan much better.

If you didn’t follow your plan, ask yourself why not and what you

should do differently next time to help you follow it. Find out why you

put on every trade, and why you got out of them. If you are diligent about

sticking to a plan, then you don’t have much work to do here, but always

review to make sure you stick to your guns.

The Good Losers

Some losing trades are good trading decisions that didn’t work out and if

you got out with a small loss when you were supposed to, I don’t consider

it a bad trade. A bad trade is when you let it get away or make a stupid, unplanned

trade. Being able to take a good losing trade is the most important

trade of all and this is a behavior I want to reinforce. The reason I think

they are the most important trades of all is that your money is made as a

total of all your trades—winners and losers. You will have losing trades,

and you cannot get around that no matter how good you think you are. But

if you are able to limit losses to a manageable amount and avoid the huge

losses, your net profits will soar and you will be a better trader. I am more

proud of getting out of something with a small loss that would have turned

out to be worse, than I am about having a winning trade. Everyone can get

lucky and make a great winning trade here and there, but only good traders

know how to get out at the right time on the losing side. Even though I may

have lost money on a trade it is a good trade if I did the right thing. When

I review these trades I look to remember what I did to make me get out

quickly so that if I see that situation again I hope to act correctly the next

time as well.

Ones That Got Away

Next you can go over the ones that you just let go. These trades usually fall

into two categories, either you overstayed your welcome and gave back

too much on a winner, or you let a loser go and froze up as you watched it

disintegrate. Either way they are going to really affect your P&L statement.

It only takes one bad trade to wipe you out, even after 10 winners in a row,

so try as hard as possible to not let it happen. You have got to learn to stick

to your exit plans and constantly reviewing this will definitely help.

Don’t be satisfied that you made money on a trade. If you had a 50-

point winner that you turned into a 3-point winner, you screwed up that

trade and gave back your money. At the end of the day, week, month, or

year it’s a total of all your trades that determines how you did, so don’t take

it too lightly if you take a small winner that was once a big one. You lost

that 47 points, that was your money to be had. Find out why.

If I let a trade get really bad, I try to see why I did so, so I don’t do it

again in the future. As you look over the trade, look for the spot you should

have gotten out and try to figure out why you didn’t. It could be because

you had no exit strategy or because you failed to follow one if you did, or

because you got greedy and tried to get more than you could out of a trade.

Or did you freeze up and hope a loser would come back? There are many

reasons you could let a trade get beyond the point where you were suppose

to get out. Figure out why you did so and work on not doing it again. These

are the trades you need to work on the most on because they will draw

down your account faster than the good trades will add to it.

The Good Winners

The last thing I review is my good winning trades and again I’ll try to learn

from them. Good winners are the trades you did everything right on and

made some decent money with. Don’t just look at it and say “good trade”

and move on. Really delve into it. Ask yourself, “Why was it a good trade

and what did I do right?” Did you just get lucky or did you really do something

right. If you did something right, then make sure you keep doing it.

By studying trades you may find that every time you make a trade with a

certain setup it works great, but if a certain variable was changed a little it

doesn’t work as well. Only thorough reviewing will tell you things like this.

If you are a person who has trouble following a game plan, and odds

are you are or you wouldn’t have bought this book, keep track of how you

did on trades where you followed a plan, had an entry point, and came up

with a predetermined exit level. And then keep track of those trades you

put on with little preparation. Next, compare them to see how they do.

Hopefully you will see a big discrepancy and realize that you need to have

and follow a strategy/plan when you trade if you really want to succeed.

THINKING ABOUT TOMORROW

As you go over all your open trades, you need to keep thinking about them

in the future. You will want to draw up different scenarios for each trade

and make notes as to how you will react if that situation arises. I like to

think up different possibilities of what the market can do and draw up targets

and exit points for them. I’ll anticipate if I will add to or subtract from

a position. Doing this keeps me from getting surprised when something

does happen. Maybe there is an earnings report coming out, and there is

a chance it can cause your stock to move. As a good trader you will be

prepared for anything that stock could do the next day.

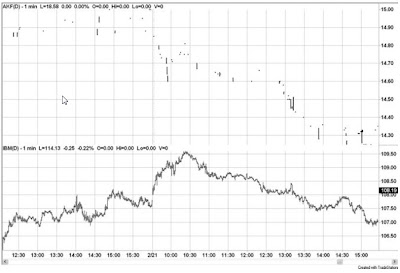

For example, if you were long in Figure 7.5 you could start preparing

for anything that could happen the next day and in the near future. You

may say, “If the market breaks above the double top line I will add five

contracts to my position, with a target of 14,300, and I’ll raise my stop to

under yesterday’s low to the Stop 2 level. However, if it drops below the

double bottom, I’ll exit all my longs and reverse and use the double top

area as a stop. If the market stays within the range it is in now, I’ll keep my

current stop (Stop 1) and do nothing.”

Planning out current trades will start to take the gamble out of your

trading as it’s much better to have all your scenarios planned out before

they happen and surprise you. You can get more elaborate and consider

what you will do if the market opens up 50 points and rallies or reverses

after the up open or what you’ll do if it opens below the support line. The

possibilities are endless and the better you have them considered in your

game plan the better you will do.

This isn’t an end-all list of things to look for when going over your

open trades. You may have special criteria you want to keep track of on

your own, or you may have things that are specific to the way you trade or

the markets you trade. I can’t come up with every little thing, but part of

trading is that you should always be learning and finding ways to improve,

so work a little on figuring out other things to look for when going over

your trades.

in the future. You will want to draw up different scenarios for each trade

and make notes as to how you will react if that situation arises. I like to

think up different possibilities of what the market can do and draw up targets

and exit points for them. I’ll anticipate if I will add to or subtract from

a position. Doing this keeps me from getting surprised when something

does happen. Maybe there is an earnings report coming out, and there is

a chance it can cause your stock to move. As a good trader you will be

prepared for anything that stock could do the next day.

For example, if you were long in Figure 7.5 you could start preparing

for anything that could happen the next day and in the near future. You

may say, “If the market breaks above the double top line I will add five

contracts to my position, with a target of 14,300, and I’ll raise my stop to

under yesterday’s low to the Stop 2 level. However, if it drops below the

double bottom, I’ll exit all my longs and reverse and use the double top

area as a stop. If the market stays within the range it is in now, I’ll keep my

current stop (Stop 1) and do nothing.”

Planning out current trades will start to take the gamble out of your

trading as it’s much better to have all your scenarios planned out before

they happen and surprise you. You can get more elaborate and consider

what you will do if the market opens up 50 points and rallies or reverses

after the up open or what you’ll do if it opens below the support line. The

possibilities are endless and the better you have them considered in your

game plan the better you will do.

This isn’t an end-all list of things to look for when going over your

open trades. You may have special criteria you want to keep track of on

your own, or you may have things that are specific to the way you trade or

the markets you trade. I can’t come up with every little thing, but part of

trading is that you should always be learning and finding ways to improve,

so work a little on figuring out other things to look for when going over

your trades.

THE OPEN TRADES

Many of the situations below can apply to winning and losing trades, so

I’m not going to separate them into two sections. Just figure out which

applies to your situations as you read them. A winning and losing trade

can be looked at the same way depending on how long you have held a

position. A winning trade that gives back too much profit is no worse than

a losing trade. You don’t want to give back too much on a winning position

by overstaying your welcome. Even if you close it out as a winner, if you

gave back too much, in my eyes it’s a bad trade at least for the last part of

the trade. Though I prefer to review my winners first, it doesn’t matter if

you do them or your losers first or if you just go down your list of trades

in the order that you put them on. Whatever way you do it, just be sure to

give them all their fair due. If you are a day trader who closes everything

out at the end of the day then the next few pages may not be necessary, but

you paid for the book, so the read them anyway. If you trade one market

or stock, the reviewing part will go faster and then you could meet John at

Moran’s quicker. As you do go over every trade keep in mind that the main

purpose for doing so is to prepare for the next day’s game plan.

Why Did I Make the Trade?

The first thing I do when I look at my open trades is to start with ones I put

on most recently. I ask myself, “Why did I make this trade?” Throughout a

trade’s history you need to keep making sure that it is within your plan’s scope. I want to make sure that the trade is part of my trading strategy and

not some randomly put on trade. I want validation that I made the trade

for a proper reason. If I did, great, I can move on; if not, I want to make

sure it fits into one of my strategies. If it doesn’t, I’ll look to get out as

soon as possible, as I do not want to hold a trade that contradicts my basic

principles. Sometimes during the heat of battle of the trading day, you may

make some random trade and then not get out of it because you had no

plan for it. Hopefully this doesn’t happen often to you, but when it does, be

aware you are doing something wrong and remedy it as soon as you can.

Do the Reasons You Got in Still Hold?

If you shorted the Dow Jones because the 3-period moving average crossed

below the 10-period one as in point A in Figure 7.1, make sure it’s still the

case. If it’s not, it’s time to reevaluate the trade. Don’t wait until you are

stopped out to get out of a trade that isn’t working, if things have changed,

it’s okay to get out. In Figure 7.1 if you got out after the 3-period moving

average crossed back over the 10-period one, instead of waiting for the stop

to be elected you would have saved yourself about 200 points.

If it’s still within the parameters that got you in, look to see if they may

be changing, so you can anticipate an exit. Maybe the trade is still good but

FIGURE 7.1 Daily Dow

Source: © TradeStation Technologies 1999. All rights reserved.

it’s getting close to not being so, so you may have to watch it more carefully

tomorrow. Make a note of this and keep it on your radar screen (I’m not

referring to TradeStation’s radar screen but to your personal one). Make

sure if a trade is getting close to being one you have to exit that you are

on top of it. In the example in Figure 7.1 you can see the 3-period moving

average turning up and the highs of each bar getting higher prior to the

crossover at point B. This could be a sign your trade may not be within

the reasons you sold it for much longer, so you can start getting ready

for action.

Is It Simply Not Working as Planned?

Another thing you should monitor is whether the trade is working like you

planned. Yes, it could still be within your parameters, but maybe you were

looking to get a quick move on the trade and after three days it’s been stagnant,

not doing a thing. You need to consider whether you still want to hold

and monitor this dud? Your time and money could maybe be better spent

elsewhere. So why not get out? The trade is not doing what you wanted it

to, so you can consider moving on, though before you do make sure you

gave it an opportunity to work. If you look at Figure 7.1 again you’ll see this

as well. Assuming you got filled on the short at the first circle, the market

did nothing for the next few days. You expected it to go down right away

and it hasn’t. Even though the moving averages are still confirming a short,

you may consider getting out as it’s simply not performing as you’d like it

to, especially on the fourth day. At this point, you gave it time to work and

it didn’t and now it looks like it may pop back up.

Is It Close to the Target Area?

Once your trade starts getting close to the target area that you should have

established when you put the trade on, you should begin to monitor it more

closely. The target area can be a number, like when the market hits 13,541

or it can be a technical target as in when the market reaches the top of a

channel. It can be a time target as in exit after seven periods. Whichever the

case, you want to be aware that it’s getting close so that you can get ready

to act on it the next day if the target is reached. You may, after reevaluating,

consider moving the target, which is always an option, but make sure you

have a reason for it if you do. In Figure 7.2 I used Fibonacci projections

based on the up trend that started in July, to pick a target for a long using

a breakout of a previous high. As soon as the market gets within about two

normal days range from this target area (13,531), I would monitor it much

more closely to determine when I need to get out. One thing you need to

be on the lookout for is that it may fail to reach the target, in which case

you need a backup plan as to what to do. I do this by constantly moving my

stop up in a big move like this.

Has It Reached the Target Area?

Not only do you have to look to see if a trade is near its target area, you

should also keep an eye out for trades that have already hit your target

area. Let’s say the market traded through a channel you had set as a target.

You didn’t exit because maybe the move was strong and you wanted to let

your profits ride, which is a valid excuse. You now need to reevaluate the

exit points. Should you come up with a new target and stop areas or should

you get out, because your original level was hit? You could maybe keep the

trade and use your old target as your new stop. You really want to be on

top of a trade like this because there is no worse feeling then having a trade

reach its target and then some, then getting a little greedy and before you

know it goes against you and it turns into a loser. These losers are hard to

exit because you keep thinking it will come back to the best levels of the

trade and you end up just watching it fade away. Let’s say in Figure 7.2 you

did not exit at the target level and now the market is trading in the second

circle. You need to now reevaluate the trade as a new trade and determine

if you’d like to keep it as well as make a new target (target 2) and create a

new stop level (stop 2). You may introduce new technical indicators to help

you decide. I personally would have gotten out the second time it dipped

below the 13,531 level. I would have given it one time to test the level and

if it dipped below a second time I would exit. The reason being that I gave

it a shot to work and it didn’t right away, and it has already reached the

target so why not get out?

Is It Approaching a Stop Level?

Just as when the trade is getting close to its target level, you also should

be aware of any trades getting close to their stop levels. The closer it is to

the stop point, the more you should pay attention, or maybe paying less attention

is the better way to say it. Thinking too much about stops is a great

way to cancel or move them, as the market gets closer to them. Sometimes

your stops are mental and now is the time to either place them in or really

watch the market so you can exit it if it does hit the level. If you are

near a stop level, I recommend putting the stop in and forgetting about it.

Do not try to second-guess it. If your original stop was well thought out,

there is little reason to move it as the market gets closer. Most of the time

you will end up losing more money by moving or ignoring a stop. You do,

however, need to go over, review, and adjust stop levels on a regular basis.

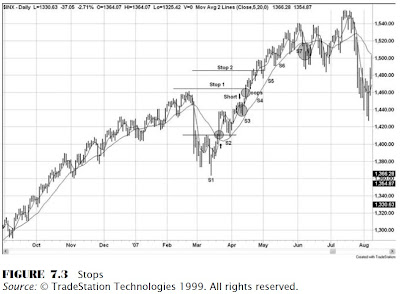

But I would not be moving them further away as they get closer for fear of getting stopped out. Look at Figure 7.3 and you’ll see two different scenarios,

the first is the long from the first shaded circle, which is the same from

the previous example. As the market started getting better I would move

the stops S2, S3, S4, and so forth, up along the with moving average until

eventually the market catches up to it at S7 and you get stopped out; this

is the proper way to move a stop. The wrong way is the other example.

Say you shorted at the arrow marked Short and you placed a stop (Stop1)

above previous highs. But a couple of days later the market rallies strong

(oops). Now instead of leaving your stop in and taking it like a man, you

move it up to Stop 2 to give the market room to breathe. All you are doing

here is costing yourself 200 more points for no reason. As the market

reaches the stop level you have reasoned to be good, leave it alone. I’ll get

into this in more detail later in the book.

Did You Ignore Stop Levels?

This section assumes you are a moron and let the market go through the

level where you should have placed your stop. I’ll discuss it later in the

book, but you should not make a trade unless you know where you are

getting out on both the winning and losing side. Maybe you had a mental

stop, but froze and never put it on, or worse, you never even thought about

one and just hoped for the best. Maybe you’ve been in the trade for a while

and are making money and got a little lackadaisical moving a stop along to

lock in a profit. Regardless of the reason, if you ignored a stop you need

to put this trade on your “I must get the hell out of it soon” list and make

sure you are on top of it first thing in the morning. If you go back to Figure

7.3 and for some reason you let the short keep going and did not enter

the stop at Stop 2 and now it’s trading above that, you really need to force

yourself out of the trade the next day. Cutting your losses is something you

need to learn and emphasize as you are making your game plan every day.

Ignoring stops will definitely lead you down the wrong path, so should you

find yourself in a position where you did ignore one and are now in danger,

do not sit there and hope for the best; instead, get out and take the loss.

Should You Add to It or Cut Back?

Position size is another decision you should be thinking about as you go

over every trade. If, as in the example in Figure 7.2, the market reached

your target area and the trade is still working, why not take off some of

the trade and lock in a little profit, but keep a little if you think it still has

room. Maybe, on the other hand, it’s earlier in the trade and the market

just broke above the Break Out X line. Here you can have another strategy

that kicks in when you break out of this resistance level. You are already in

the trade with a nice profit and now you get confirmation of a strong trade

with a new signal. In this situation you may want to consider adding to the

position as the trade just got better in your eyes.

What, however, if the trade isn’t really working as well as you had intended

it to, but you don’t want to get out in case it does take off? A good

strategy here is to reduce the size of the position while still holding onto

some of it, just in case it does end up working. Cutting back and scaling is

one of the hardest things to do in trading, as you can probably make a case

for both sides in every instance. No matter what you do never ever forget

the cardinal rule of never adding to a loser.

Is Your Money Better Spent Elsewhere?

A part of the thinking process in the above scenarios when deciding on adjusting

position size is that if you take off a portion of your trade, it will

free up money to be used elsewhere. As you go over every trade keep that

in mind and ask yourself, “Is my money better spent elsewhere?” If the

answer is yes you may be better off getting out and putting on a different

trade. Or at least keeping money on the sidelines for when a better

setup does come along. You should not be in the habit of being maxed

out, but many new traders have limited funds and can quickly reach their margin levels. Freeing up some money then becomes part of their everyday

game plan.

Should a Trade Be Closed Now or Held Longer?

Which leads to the question, “Should I hold or get out?” If you have a purely

mechanical system then you shouldn’t override it and as such you should

only get out when a signal is given. However, this book deals mostly with

discretionary systems, which leaves a trader to make a lot of decisions.

Althoughmost everything mentioned above comes down to this basic question.

Ask it out loud. “Should I get out or stay in?” Keep singing the Clash’s

song “Should I stay or should I go?” until it becomes second nature. Ask

yourself, “If I didn’t have this position on would I get in now?” If the answer

is no, you should get out and move on. Don’t waste your time, money,

and energy on positions you do not feel like you would have on if you had a

fresh start. There have been many times where I’ve been married to a position

I knew was wrong, but I couldn’t make myself get out of it. I’d be long

losing money and I knew that if I had no trade on I’d want to be getting

short, because the market looked so bearish. Yet I couldn’t bring myself

to take a loss. Eventually I found that taking a loss is okay, and doing it

will save you lots of money over time. So learn to do it. Now this doesn’t

just apply to losing trades, you could have trades that are winners but are

no longer doing anything. You may want to reevaluate those as well every

night, and if you believe or your strategies tell you it’s done, get out and

move on.

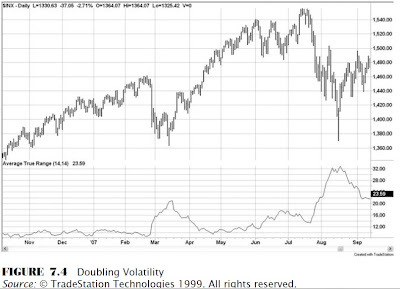

Has Volatility Changed?

As I write this, the volatility in the stock market has recently exploded.

As you can see by looking at the Average True Range (ATR) in Figure 7.4,

the S&Ps range has more than doubled in the last couple of weeks of trading.

The average trading range went from under 12 points a day to well

over 20 for the month of August. You must be aware of this as you trade

because the dynamics of any trade made before this just got different. Targets

and stops may need to be moved further away to make them realistic.

The market may now be too dangerous for you to trade and you may have

to reconsider your strategy. If you had a stop that was to get out after two

consecutive days of negative closes and before you thought you were risking

$2,000 dollars, well that risk may now be $5,000 and you may not be able

to afford it. Likewise, you may have a fixed stop that is about $2,000 away,

but now that can easily be hit by a modest intraday swing, so you’ll get

stopped out when technically you shouldn’t have been. When the volatility

changes dramatically you must reconsider your positions. Even if the

volatility changes to be smaller, you should still reconsider your positions.

You may now want to add to your position or move your targets in to be

more reasonable. Volatility may not have drastic changes often but when it

does, be prepared to alter your strategy and game plan accordingly.

What Was in the News?

Another thing I think traders should look at is why the markets moved like

they did. If you were in a trade that acted out of the ordinary, find out why

it did so. It may not help you much on closed trades, but it’s good to know

if you still have a trade open. Though I don’t like trading off of the news, it

can sometimes change the nature of a trade, and you should be aware of it.

Many news events are blips that will give a market a nice swing, but in the

long run don’t make a difference. But there are some that can be the cause

of a market reversal, like when the Fed cuts rates more than expected, or

a central bank tightens its monetary policy, or a company reports really

bad financial news, or a CEO gets arrested out of the blue for accounting

fraud. If news made something move, even just for the day, it’s good to be

aware of it so you can make a more educated game plan the next day. I

always find trading how a market reacts to news to be a powerful tool, and you can take advantage of it if you incorporate that information into your

game plan.

I’m not going to separate them into two sections. Just figure out which

applies to your situations as you read them. A winning and losing trade

can be looked at the same way depending on how long you have held a

position. A winning trade that gives back too much profit is no worse than

a losing trade. You don’t want to give back too much on a winning position

by overstaying your welcome. Even if you close it out as a winner, if you

gave back too much, in my eyes it’s a bad trade at least for the last part of

the trade. Though I prefer to review my winners first, it doesn’t matter if

you do them or your losers first or if you just go down your list of trades

in the order that you put them on. Whatever way you do it, just be sure to

give them all their fair due. If you are a day trader who closes everything

out at the end of the day then the next few pages may not be necessary, but

you paid for the book, so the read them anyway. If you trade one market

or stock, the reviewing part will go faster and then you could meet John at

Moran’s quicker. As you do go over every trade keep in mind that the main

purpose for doing so is to prepare for the next day’s game plan.

Why Did I Make the Trade?

The first thing I do when I look at my open trades is to start with ones I put

on most recently. I ask myself, “Why did I make this trade?” Throughout a

trade’s history you need to keep making sure that it is within your plan’s scope. I want to make sure that the trade is part of my trading strategy and

not some randomly put on trade. I want validation that I made the trade

for a proper reason. If I did, great, I can move on; if not, I want to make

sure it fits into one of my strategies. If it doesn’t, I’ll look to get out as

soon as possible, as I do not want to hold a trade that contradicts my basic

principles. Sometimes during the heat of battle of the trading day, you may

make some random trade and then not get out of it because you had no

plan for it. Hopefully this doesn’t happen often to you, but when it does, be

aware you are doing something wrong and remedy it as soon as you can.

Do the Reasons You Got in Still Hold?

If you shorted the Dow Jones because the 3-period moving average crossed

below the 10-period one as in point A in Figure 7.1, make sure it’s still the

case. If it’s not, it’s time to reevaluate the trade. Don’t wait until you are

stopped out to get out of a trade that isn’t working, if things have changed,

it’s okay to get out. In Figure 7.1 if you got out after the 3-period moving

average crossed back over the 10-period one, instead of waiting for the stop

to be elected you would have saved yourself about 200 points.

If it’s still within the parameters that got you in, look to see if they may

be changing, so you can anticipate an exit. Maybe the trade is still good but

FIGURE 7.1 Daily Dow

Source: © TradeStation Technologies 1999. All rights reserved.

it’s getting close to not being so, so you may have to watch it more carefully

tomorrow. Make a note of this and keep it on your radar screen (I’m not

referring to TradeStation’s radar screen but to your personal one). Make

sure if a trade is getting close to being one you have to exit that you are

on top of it. In the example in Figure 7.1 you can see the 3-period moving

average turning up and the highs of each bar getting higher prior to the

crossover at point B. This could be a sign your trade may not be within

the reasons you sold it for much longer, so you can start getting ready

for action.

Is It Simply Not Working as Planned?

Another thing you should monitor is whether the trade is working like you

planned. Yes, it could still be within your parameters, but maybe you were

looking to get a quick move on the trade and after three days it’s been stagnant,

not doing a thing. You need to consider whether you still want to hold

and monitor this dud? Your time and money could maybe be better spent

elsewhere. So why not get out? The trade is not doing what you wanted it

to, so you can consider moving on, though before you do make sure you

gave it an opportunity to work. If you look at Figure 7.1 again you’ll see this

as well. Assuming you got filled on the short at the first circle, the market

did nothing for the next few days. You expected it to go down right away

and it hasn’t. Even though the moving averages are still confirming a short,

you may consider getting out as it’s simply not performing as you’d like it

to, especially on the fourth day. At this point, you gave it time to work and

it didn’t and now it looks like it may pop back up.

Is It Close to the Target Area?

Once your trade starts getting close to the target area that you should have

established when you put the trade on, you should begin to monitor it more

closely. The target area can be a number, like when the market hits 13,541

or it can be a technical target as in when the market reaches the top of a

channel. It can be a time target as in exit after seven periods. Whichever the

case, you want to be aware that it’s getting close so that you can get ready

to act on it the next day if the target is reached. You may, after reevaluating,

consider moving the target, which is always an option, but make sure you

have a reason for it if you do. In Figure 7.2 I used Fibonacci projections

based on the up trend that started in July, to pick a target for a long using

a breakout of a previous high. As soon as the market gets within about two

normal days range from this target area (13,531), I would monitor it much

more closely to determine when I need to get out. One thing you need to

be on the lookout for is that it may fail to reach the target, in which case

you need a backup plan as to what to do. I do this by constantly moving my

stop up in a big move like this.

Has It Reached the Target Area?

Not only do you have to look to see if a trade is near its target area, you

should also keep an eye out for trades that have already hit your target

area. Let’s say the market traded through a channel you had set as a target.

You didn’t exit because maybe the move was strong and you wanted to let

your profits ride, which is a valid excuse. You now need to reevaluate the

exit points. Should you come up with a new target and stop areas or should

you get out, because your original level was hit? You could maybe keep the

trade and use your old target as your new stop. You really want to be on

top of a trade like this because there is no worse feeling then having a trade

reach its target and then some, then getting a little greedy and before you

know it goes against you and it turns into a loser. These losers are hard to

exit because you keep thinking it will come back to the best levels of the

trade and you end up just watching it fade away. Let’s say in Figure 7.2 you

did not exit at the target level and now the market is trading in the second

circle. You need to now reevaluate the trade as a new trade and determine

if you’d like to keep it as well as make a new target (target 2) and create a

new stop level (stop 2). You may introduce new technical indicators to help

you decide. I personally would have gotten out the second time it dipped

below the 13,531 level. I would have given it one time to test the level and

if it dipped below a second time I would exit. The reason being that I gave

it a shot to work and it didn’t right away, and it has already reached the

target so why not get out?

Is It Approaching a Stop Level?

Just as when the trade is getting close to its target level, you also should

be aware of any trades getting close to their stop levels. The closer it is to

the stop point, the more you should pay attention, or maybe paying less attention

is the better way to say it. Thinking too much about stops is a great

way to cancel or move them, as the market gets closer to them. Sometimes

your stops are mental and now is the time to either place them in or really

watch the market so you can exit it if it does hit the level. If you are

near a stop level, I recommend putting the stop in and forgetting about it.

Do not try to second-guess it. If your original stop was well thought out,

there is little reason to move it as the market gets closer. Most of the time

you will end up losing more money by moving or ignoring a stop. You do,

however, need to go over, review, and adjust stop levels on a regular basis.

But I would not be moving them further away as they get closer for fear of getting stopped out. Look at Figure 7.3 and you’ll see two different scenarios,

the first is the long from the first shaded circle, which is the same from

the previous example. As the market started getting better I would move

the stops S2, S3, S4, and so forth, up along the with moving average until

eventually the market catches up to it at S7 and you get stopped out; this

is the proper way to move a stop. The wrong way is the other example.

Say you shorted at the arrow marked Short and you placed a stop (Stop1)

above previous highs. But a couple of days later the market rallies strong

(oops). Now instead of leaving your stop in and taking it like a man, you

move it up to Stop 2 to give the market room to breathe. All you are doing

here is costing yourself 200 more points for no reason. As the market

reaches the stop level you have reasoned to be good, leave it alone. I’ll get

into this in more detail later in the book.

Did You Ignore Stop Levels?

This section assumes you are a moron and let the market go through the

level where you should have placed your stop. I’ll discuss it later in the

book, but you should not make a trade unless you know where you are

getting out on both the winning and losing side. Maybe you had a mental

stop, but froze and never put it on, or worse, you never even thought about

one and just hoped for the best. Maybe you’ve been in the trade for a while

and are making money and got a little lackadaisical moving a stop along to

lock in a profit. Regardless of the reason, if you ignored a stop you need

to put this trade on your “I must get the hell out of it soon” list and make

sure you are on top of it first thing in the morning. If you go back to Figure

7.3 and for some reason you let the short keep going and did not enter

the stop at Stop 2 and now it’s trading above that, you really need to force

yourself out of the trade the next day. Cutting your losses is something you

need to learn and emphasize as you are making your game plan every day.

Ignoring stops will definitely lead you down the wrong path, so should you

find yourself in a position where you did ignore one and are now in danger,

do not sit there and hope for the best; instead, get out and take the loss.

Should You Add to It or Cut Back?

Position size is another decision you should be thinking about as you go

over every trade. If, as in the example in Figure 7.2, the market reached

your target area and the trade is still working, why not take off some of

the trade and lock in a little profit, but keep a little if you think it still has

room. Maybe, on the other hand, it’s earlier in the trade and the market

just broke above the Break Out X line. Here you can have another strategy

that kicks in when you break out of this resistance level. You are already in

the trade with a nice profit and now you get confirmation of a strong trade

with a new signal. In this situation you may want to consider adding to the

position as the trade just got better in your eyes.

What, however, if the trade isn’t really working as well as you had intended

it to, but you don’t want to get out in case it does take off? A good

strategy here is to reduce the size of the position while still holding onto

some of it, just in case it does end up working. Cutting back and scaling is

one of the hardest things to do in trading, as you can probably make a case

for both sides in every instance. No matter what you do never ever forget

the cardinal rule of never adding to a loser.

Is Your Money Better Spent Elsewhere?

A part of the thinking process in the above scenarios when deciding on adjusting

position size is that if you take off a portion of your trade, it will

free up money to be used elsewhere. As you go over every trade keep that

in mind and ask yourself, “Is my money better spent elsewhere?” If the

answer is yes you may be better off getting out and putting on a different

trade. Or at least keeping money on the sidelines for when a better

setup does come along. You should not be in the habit of being maxed

out, but many new traders have limited funds and can quickly reach their margin levels. Freeing up some money then becomes part of their everyday

game plan.

Should a Trade Be Closed Now or Held Longer?

Which leads to the question, “Should I hold or get out?” If you have a purely

mechanical system then you shouldn’t override it and as such you should

only get out when a signal is given. However, this book deals mostly with

discretionary systems, which leaves a trader to make a lot of decisions.

Althoughmost everything mentioned above comes down to this basic question.

Ask it out loud. “Should I get out or stay in?” Keep singing the Clash’s

song “Should I stay or should I go?” until it becomes second nature. Ask

yourself, “If I didn’t have this position on would I get in now?” If the answer

is no, you should get out and move on. Don’t waste your time, money,

and energy on positions you do not feel like you would have on if you had a

fresh start. There have been many times where I’ve been married to a position

I knew was wrong, but I couldn’t make myself get out of it. I’d be long

losing money and I knew that if I had no trade on I’d want to be getting

short, because the market looked so bearish. Yet I couldn’t bring myself

to take a loss. Eventually I found that taking a loss is okay, and doing it

will save you lots of money over time. So learn to do it. Now this doesn’t

just apply to losing trades, you could have trades that are winners but are

no longer doing anything. You may want to reevaluate those as well every

night, and if you believe or your strategies tell you it’s done, get out and

move on.

Has Volatility Changed?

As I write this, the volatility in the stock market has recently exploded.

As you can see by looking at the Average True Range (ATR) in Figure 7.4,

the S&Ps range has more than doubled in the last couple of weeks of trading.

The average trading range went from under 12 points a day to well

over 20 for the month of August. You must be aware of this as you trade

because the dynamics of any trade made before this just got different. Targets

and stops may need to be moved further away to make them realistic.

The market may now be too dangerous for you to trade and you may have

to reconsider your strategy. If you had a stop that was to get out after two

consecutive days of negative closes and before you thought you were risking

$2,000 dollars, well that risk may now be $5,000 and you may not be able

to afford it. Likewise, you may have a fixed stop that is about $2,000 away,

but now that can easily be hit by a modest intraday swing, so you’ll get

stopped out when technically you shouldn’t have been. When the volatility

changes dramatically you must reconsider your positions. Even if the

volatility changes to be smaller, you should still reconsider your positions.

You may now want to add to your position or move your targets in to be

more reasonable. Volatility may not have drastic changes often but when it

does, be prepared to alter your strategy and game plan accordingly.

What Was in the News?

Another thing I think traders should look at is why the markets moved like

they did. If you were in a trade that acted out of the ordinary, find out why

it did so. It may not help you much on closed trades, but it’s good to know

if you still have a trade open. Though I don’t like trading off of the news, it

can sometimes change the nature of a trade, and you should be aware of it.

Many news events are blips that will give a market a nice swing, but in the

long run don’t make a difference. But there are some that can be the cause

of a market reversal, like when the Fed cuts rates more than expected, or

a central bank tightens its monetary policy, or a company reports really

bad financial news, or a CEO gets arrested out of the blue for accounting

fraud. If news made something move, even just for the day, it’s good to be

aware of it so you can make a more educated game plan the next day. I

always find trading how a market reacts to news to be a powerful tool, and you can take advantage of it if you incorporate that information into your

game plan.

G O O D K I D , B A D K I D

A great example of this is parents with two kids, one who is near perfect, a

straight-A student, captain of the tennis team, doing community service, and

the other is cutting class, failing some classes, getting into fights, smoking

cigarettes, shaving half his head, and so on. The parents can spend so much

time talking about and dealing with the bad seed that the good kid starts to feel abandoned. He starts getting depressed thinking that they don’t love him as much as his brother and soon begins drinking heavily. Then he finds some of

his brother’s pot and because no one pays attention he quickly develops a $5 a

day pot habit. So the moral here is to cut your losses, send the troubled kid to

military school, and praise the good kid; odds are he’ll make more money in the

future than the troublemaker allowing you to retire earlier, as he supports you.

The bad kid on the other hand is going to cost you money for years, military

school, bail, lawyers, counseling, hair dye, and so on. So cut your losses and

concentrate on your winners.

Now back from my tangent, as you are reviewing don’t get complacent

with good trades. Analyze them in depth and always think about how you

will get out. As you review your trades there are several things you can look

at as I’ll describe in the rest of this chapter. I’ll start with the open trades.

straight-A student, captain of the tennis team, doing community service, and

the other is cutting class, failing some classes, getting into fights, smoking

cigarettes, shaving half his head, and so on. The parents can spend so much

time talking about and dealing with the bad seed that the good kid starts to feel abandoned. He starts getting depressed thinking that they don’t love him as much as his brother and soon begins drinking heavily. Then he finds some of

his brother’s pot and because no one pays attention he quickly develops a $5 a

day pot habit. So the moral here is to cut your losses, send the troubled kid to

military school, and praise the good kid; odds are he’ll make more money in the

future than the troublemaker allowing you to retire earlier, as he supports you.

The bad kid on the other hand is going to cost you money for years, military

school, bail, lawyers, counseling, hair dye, and so on. So cut your losses and

concentrate on your winners.

Now back from my tangent, as you are reviewing don’t get complacent

with good trades. Analyze them in depth and always think about how you

will get out. As you review your trades there are several things you can look

at as I’ll describe in the rest of this chapter. I’ll start with the open trades.

LET’S REVIEW

This chapter may seem out of order at times because it assumes you are

doing things that I’ll discuss throughout the book some of which will come

later. However, I put it here because the best way to start your trading day

is to get ready for it the night before. But before you start getting ready for

the next trading day, the first thing you should do is go over all the trades

you made or have on. You can do this in any order you like, but I prefer

to start by looking at any trades I have that are still open. These are the

ones I need to be the most focused on going into the next day, and I like to

confirm that they are still good trades.

By “good” I mean that the reasons I put the trade on are still valid.

I’ve been known to not get out of bad trades in hopes of them opening

up the next day in my favor. This is always a bad decision as bad trades

should always be gotten out of as soon as possible. Now this is different

from a trade that is not making money but is still in the parameters of your

strategy. I’m referring to trades that blow through your levels but that you

have decided not to get out of.

If I still have a bad trade on after the day, I make a big note to GET

OUT if it does not start reacting correctly as soon as the market opens. It’s

oh-so-common to look at a bad position and rationalize why it could work.

For example, if it gaps down against you the next day, you may say, okay

this is the worst it can get and it will close the gap. And you sit there and

hope all day it does. Doing this could easily throw off your whole game plan

for the next day as you will spend too much time babying a bad position

and ignoring the good ones you have, which may end up turning bad.

doing things that I’ll discuss throughout the book some of which will come

later. However, I put it here because the best way to start your trading day

is to get ready for it the night before. But before you start getting ready for

the next trading day, the first thing you should do is go over all the trades

you made or have on. You can do this in any order you like, but I prefer

to start by looking at any trades I have that are still open. These are the

ones I need to be the most focused on going into the next day, and I like to

confirm that they are still good trades.

By “good” I mean that the reasons I put the trade on are still valid.

I’ve been known to not get out of bad trades in hopes of them opening

up the next day in my favor. This is always a bad decision as bad trades

should always be gotten out of as soon as possible. Now this is different

from a trade that is not making money but is still in the parameters of your

strategy. I’m referring to trades that blow through your levels but that you

have decided not to get out of.

If I still have a bad trade on after the day, I make a big note to GET

OUT if it does not start reacting correctly as soon as the market opens. It’s

oh-so-common to look at a bad position and rationalize why it could work.

For example, if it gaps down against you the next day, you may say, okay

this is the worst it can get and it will close the gap. And you sit there and

hope all day it does. Doing this could easily throw off your whole game plan

for the next day as you will spend too much time babying a bad position

and ignoring the good ones you have, which may end up turning bad.

After the Close

A man rushes into his house and yells to his wife, “Martha, pack

up your things! I just made a fortune in the stock market!” Martha

replies, “Wow, should I pack for warm weather or cold?” The man

responds, “I don’t care. Just get out!”

So, it’s 4:15 P.M. and the S&P futures just closed and you had a bad

day trading, so what do you do? Go down to your local bar and get

soused? No, you start preparing for the next day. Actually, first you

should run to the bathroom as you probably have been sitting for four

hours straight glued to your monitor. Then go take a quick walk to stretch

out and clear your mind. If you work on a trading desk at a day trading firm

most likely everyone will be gone when you come back. But the next hour

or so could be the most valuable one of your trading day. You’re thinking

the markets are closed, I can’t trade anymore, the day is over, why should I

still be here? But it’s only the end of the day for John and his loser friends.

Great traders use this time to review their day and start planning for the

next one. As soon as the market closes is when your trades are freshest in

your mind, so why not spend some time after the close going over them?

You can gain a lot of insight into your trading by reviewing what you have

done and what’s more, you can start getting ready for tomorrow by doing

so. After you’ve gone over all your trades, you should take some time

preparing tomorrow’s game plan. This is a two-part process, which should

be done both the night before and the morning of, but by spending time

on it the night before you will get an incredible jump on it the following

morning and will be able to see things much clearer during the trading day.

Some things you will be concentrating on are what’s happening tomorrow,

what will you do if such and such happens, which of your trades just

aren’t working, and what are you doing wrong. You can also spend time

looking for places to adjust your stops to and review your money management

and risk levels. It doesn’t take a long time to do all this, and its worth

is invaluable.

up your things! I just made a fortune in the stock market!” Martha

replies, “Wow, should I pack for warm weather or cold?” The man

responds, “I don’t care. Just get out!”

So, it’s 4:15 P.M. and the S&P futures just closed and you had a bad

day trading, so what do you do? Go down to your local bar and get

soused? No, you start preparing for the next day. Actually, first you

should run to the bathroom as you probably have been sitting for four

hours straight glued to your monitor. Then go take a quick walk to stretch

out and clear your mind. If you work on a trading desk at a day trading firm

most likely everyone will be gone when you come back. But the next hour

or so could be the most valuable one of your trading day. You’re thinking

the markets are closed, I can’t trade anymore, the day is over, why should I

still be here? But it’s only the end of the day for John and his loser friends.

Great traders use this time to review their day and start planning for the

next one. As soon as the market closes is when your trades are freshest in

your mind, so why not spend some time after the close going over them?

You can gain a lot of insight into your trading by reviewing what you have

done and what’s more, you can start getting ready for tomorrow by doing

so. After you’ve gone over all your trades, you should take some time

preparing tomorrow’s game plan. This is a two-part process, which should

be done both the night before and the morning of, but by spending time

on it the night before you will get an incredible jump on it the following

morning and will be able to see things much clearer during the trading day.

Some things you will be concentrating on are what’s happening tomorrow,

what will you do if such and such happens, which of your trades just

aren’t working, and what are you doing wrong. You can also spend time

looking for places to adjust your stops to and review your money management

and risk levels. It doesn’t take a long time to do all this, and its worth

is invaluable.

CLOSING THOUGHTS

The better you know your stuff the better your chances of surviving are.

It does require extra work learning everything you can about the markets

you trade, but you will only be a better trader by doing so. Some of the

things I mentioned you will only gain knowledge of through time by watching

markets day in and day out. If you are lucky and have experienced

traders who you work with, you may be able to learn faster. Just don’t rush

things and expect to know how the markets will react to every piece of news disseminated out there. And don’t get stubborn about what you think

should happen. Remember the markets are always right, and they will tell

you where they should be—not the other way around.

When I was studying for my SATs I learned the word “parsimonious.”

Twenty-five years later, I don’t think I had ever used it, until this sentence.

Yes, it has nothing to do with trading but it was a thought I had while I was

rereading these closing thoughts so I figure I’d share it with you.

It does require extra work learning everything you can about the markets

you trade, but you will only be a better trader by doing so. Some of the

things I mentioned you will only gain knowledge of through time by watching

markets day in and day out. If you are lucky and have experienced

traders who you work with, you may be able to learn faster. Just don’t rush

things and expect to know how the markets will react to every piece of news disseminated out there. And don’t get stubborn about what you think

should happen. Remember the markets are always right, and they will tell

you where they should be—not the other way around.

When I was studying for my SATs I learned the word “parsimonious.”

Twenty-five years later, I don’t think I had ever used it, until this sentence.

Yes, it has nothing to do with trading but it was a thought I had while I was

rereading these closing thoughts so I figure I’d share it with you.

GETTING THE BIG PICTURE

Let’s forget about the peculiarities of individual stocks, but let’s look at

the big picture of where a stock is. When you trade, you need to know

where in time you are. Some traders have blinders on when trading and

forget to see where a market is in its long-term picture. Before you make

a trade you need to know what type of market it is because markets will

react differently in different conditions. You should be looking at charts in

multiple time frames to get both a short- and long-term picture of what the

market is doing to help determine if the market is trending, choppy, range

bound, and so on. You also need to know what the general direction of the

market is. You may also want to be using indicators to help you determine

where the current market is in relationship to the big picture. Once you

know all these things you can make smarter trading decisions.

For example, is the market in a long-term rally but has currently surged

and moved too far off its trend line and therefore due for a retracement before

going back up? Is it near the support of a range bound, choppy market

with clear support and resistance levels? Has it recently broken out of a

choppy market? Is it in a position where a possible reversal is looming?

Once you can pinpoint where a market is and know all of its levels you

can start planning trades with much less of a gambling factor than if you

were just looking at a small amount of data. Good traders will use different

technical indicators and systems depending on the market conditions.

Their game plan will vary according to where the market is versus its longterm

history. They will be able to make smarter decisions as to where to

get in and out as the picture gets clearer. All this in turn will make them

better traders.

the big picture of where a stock is. When you trade, you need to know

where in time you are. Some traders have blinders on when trading and

forget to see where a market is in its long-term picture. Before you make

a trade you need to know what type of market it is because markets will

react differently in different conditions. You should be looking at charts in

multiple time frames to get both a short- and long-term picture of what the

market is doing to help determine if the market is trending, choppy, range

bound, and so on. You also need to know what the general direction of the

market is. You may also want to be using indicators to help you determine

where the current market is in relationship to the big picture. Once you

know all these things you can make smarter trading decisions.

For example, is the market in a long-term rally but has currently surged

and moved too far off its trend line and therefore due for a retracement before

going back up? Is it near the support of a range bound, choppy market

with clear support and resistance levels? Has it recently broken out of a

choppy market? Is it in a position where a possible reversal is looming?

Once you can pinpoint where a market is and know all of its levels you

can start planning trades with much less of a gambling factor than if you

were just looking at a small amount of data. Good traders will use different

technical indicators and systems depending on the market conditions.

Their game plan will vary according to where the market is versus its longterm

history. They will be able to make smarter decisions as to where to

get in and out as the picture gets clearer. All this in turn will make them

better traders.

R O U N D-A B O U T-W A Y-W E A T H E R-C A N-A F F E C T-P R I C E S

I own a bar/restaurant and was just speaking to my produce vendor, who is a

large nationwide company. We were talking about how ridiculous prices have

gotten, and he said “you aint seen nuttin’ yet.” He was telling me how the recent

flooding in the Midwest is going to drive prices through the roof and not

just because the floods have made the grains hit record highs. It’s because his

cross-country truckers have to take alternate routes as the roads are impassable.

He said it normally costs $4,200 to send one truck cross-country, and last

week it was over $11,000 as they had to go through Canada. Between the extra

manhours and extra gasoline, coupled with all-time record-high oil prices, the

cost of a fajita at my place is going to go up.

large nationwide company. We were talking about how ridiculous prices have

gotten, and he said “you aint seen nuttin’ yet.” He was telling me how the recent